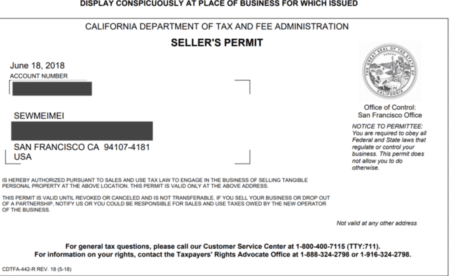

This is a typical permit. The form will look different depending on the issuing department.

Do all these names mean the same as a ‘sales tax permit’?

Yep, these terms are used interchangeably in different states, but they all refer to the same document authorizing your business to make taxable retail sales and collect sales tax from customers.

- Seller’s permit

- Retail license

- Sales tax license

- Sales and use tax permit

- Vendor’s license

- Resale permit

- Wholesale certificate

- Reseller’s permit

- Nontaxable transaction certificates

- Sales tax exemption certificate

What does it allow your business to do?

Whatever they’re called, they all give your company permission to collect sales tax from customers at the point of sale. They allow you to remit the collected sales tax to the appropriate government agency. It’s Avoid penalties and fines for non-compliance.

Does your business need a permit? Well, do you…

- Sell tangible personal property, such as clothing, furniture, and electronics?

- Sell certain services, such as restaurant meals, haircuts, and car repairs?

- Sell digital products and services, such as software and streaming services?

- Have a physical presence in the state, such as a store, office, or warehouse?

- Have economic nexus in the state, meaning they exceed a certain sales threshold, even without a physical presence?

How to register for a sales tax permit in the US

The process varies by state. However, it generally involves six steps:

1. Gather business and contact information

Typically, the registration process requires submitting general business and industry information (like your product catalog) and financial information (like total sales). The time it takes to complete a registration varies by jurisdiction.

Additionally, some jurisdictions might require you to file returns even if you don’t have any collected tax to remit.

2. Visit your state’s Department of Revenue website

Since each state has its own sales tax authority, you have to individually register to collect sales tax in each state where you have met tax registration requirements. To register for a sales tax permit, visit the state tax authority website using our guide.

Your Complyt List of State Department of Revenue Websites |

|||

Online registration link |

Fee |

Online registration link |

Fee |

| Alabama | $100 fee for online sellers | Alaska | $0 |

| Arizona | $12/location, additional city fees $1 – $50 | Arkansas | $50 |

| California | Online Only: $0 | Colorado | $4 – $16 + $50 deposit |

| Connecticut | Online Only: $100 | Delaware | No specific fee |

| Florida | $5 (mail), Online: Free | Georgia | Online Only: $0 |

| Hawaii | $20 | Idaho | $0 |

| Illinois | $0 | Indiana | Online Only: $25$20 |

| Iowa | $0 | Kansas | $0 |

| Kentucky | $0 | Louisiana | Online Only: $0 |

| Maine | $0 | Maryland | $0 |

| Massachusetts | Online Only: $0 | Michigan | $0 |

| Minnesota | $0 | Mississippi | Online Only: $0 |

| Missouri | $0 (bond may be required) | Montana | $25-$50 depending on business type |

| Nebraska | $0 | Nevada | $15/location (in-state), minimum $15 (out-of-state) |

| New Hampshire | $0 | New Jersey | $0 |

| New Mexico | $0 | New York | $0 |

| North Carolina | $0 | North Dakota | Online Only: $0 |

| Ohio | $25 (in-state), $0 (out-of-state) | Oklahoma | Online/In Person: $20 + $10/location |

| Pennsylvania | Online Only: $0 | Rhode Island | $0 |

| South Carolina | $50 (in-state), $50 (out-of-state) | South Dakota | Online: $0 |

| Tennessee | Online: $0 | Texas | $0 |

| Utah | $0 | Vermont | $0 |

| Virginia | $0 | Washington State | $50 |

| District of Columbia | Online Only: $0 | West Virginia | $30 |

| Wisconsin | $20 | Wyoming | $60 |

3. Figure out which states you need to register in

It all depends on where you have nexus.

Your company needs to register for sales tax in each state where you have met the state’s physical nexus or economic nexus standards or any other requirement. If you’re an out-of-state seller, economic nexus is generally your go-to standard for determining when to register to collect sales tax.

Economic nexus thresholds are based on sales revenue or the number of transactions you make in that state – or, in some states, both. For instance, if you do business in Pennsylvania, your company must collect sales tax if you exceed $100,000 in sales revenue or complete 200 customer transactions. Here’s a complete breakdown of these thresholds.

Your Complyt list of Economic Nexus Thresholds |

|||

State |

Economic Nexus Threshold |

State |

Economic Nexus Threshold |

| State | Economic Nexus Threshold | State | Economic Nexus Threshold |

| Alabama | $250,000 | Missouri | $100,000 or 200 transactions (bond may be required) |

| Alaska | $100,000 or 200 transactions | Montana | $25,000 – $50,000 depending on business type |

| Arizona | $100,000 | Nebraska | $100,000 or 200 transactions |

| Arkansas | $100,000 or 200 transactions | Nevada | $15/location (in-state), minimum $15 (out-of-state) |

| California | $500,000 | New Hampshire | $100,000 or 200 transactions |

| Colorado | $100,000 | New Jersey | $100,000 or 200 transactions |

| Connecticut | $100,000 or 200 transactions | New Mexico | $100,000 or 200 transactions |

| Delaware | $50,000 or 250 transactions | New York | $300,000 |

| Florida | $100,000 | North Carolina | $100,000 or 200 transactions |

| Georgia | $100,000 or 200 transactions | North Dakota | $100,000 or 200 transactions |

| Hawaii | $100,000 or 200 transactions | Ohio | $100,000 or 200 transactions (in-state), $0 (out-of-state) |

| Idaho | $100,000 | Oklahoma | $100,000 or 200 transactions (in-person), $20 + $10/location (online) |

| Illinois | $100,000 or 200 transactions | Oregon | $200,000 |

| Indiana | $100,000 or 200 transactions | Pennsylvania | $100,000 or 200 transactions (in-state), $0 (out-of-state) |

| Iowa | $100,000 or 200 transactions | Rhode Island | $100,000 or 200 transactions |

| Kansas | $100,000 | South Carolina | $50,000 (in-state), $50,000 (out-of-state) |

| Kentucky | $100,000 or 200 transactions | South Dakota | $100,000 or 200 transactions |

| Louisiana | $100,000 or 200 transactions | Tennessee | $500,000 |

| Maine | $100,000 or 200 transactions | Texas | $100,000 or 200 transactions |

| Maryland | $100,000 or 200 transactions | Utah | $100,000 or 200 transactions |

| Massachusetts | $500,000 | Vermont | $100,000 or 200 transactions |

| Michigan | $100,000 or 200 transactions | Virginia | $100,000 or 200 transactions |

| Minnesota | $100,000 or 200 transactions | Washington State | $500,000 |

Want to confirm your nexus the easy way? Book a Demo now.

4. Complete the application form

Visit your state’s Department of Revenue website using this handy list. Locate the sales tax registration section. This can be done online or by mail. Most states offer online applications, but paper versions might be available. Be sure to answer all questions accurately and thoroughly.

5. Pay the application fee

Each state has a different registration fee, usually paid online or by mail – scroll back up to take another look.

6. Submit the application and required documentation

Submit your completed application and documents to the appropriate agency. Once approved, you’ll receive your sales tax permit. This allows you to collect and remit sales tax legally.

Complyt tips

- Start early: The application process can take weeks or months, so begin early to avoid delays

- Stay informed: Keep your permit up to date and familiarize yourself with any changes in state regulations

- Seek professional advice: Consult a tax advisor or talk to our teams if you need personalized guidance in plain, jargon-free English