Who is eligible for sales tax exemptions?

Here are some general categories of organizations and situations that may be eligible for sales tax exemptions:

- Businesses purchasing goods for resale are often exempt from paying sales tax on those goods. They must resell the items in the same form without using them.

- Non-profit and charitable organizations, if recognized by the state, often qualify for sales tax exemptions.

- Federal, state, and local government agencies are typically exempt from paying sales tax.

- Schools, colleges, and other educational institutions often qualify for exemptions, especially on educational materials.

- Hospitals and other medical facilities might be exempt from sales tax on certain medical supplies and equipment.

- Farmers and agricultural businesses may be exempt from sales tax on purchases related to farming and agricultural production.

- Manufacturing or industrial production businesses may be exempt from sales tax on machinery, equipment, and sometimes raw materials used directly in production.

- Certain industries may have specific exemptions, such as SaaS or other digital goods and services, depending on the state.

What is a tax exemption?

An exemption is an exception to the rule that eliminates the buyer’s need to pay sales tax at the point of purchase. But it’s up to you, the buyer, to prove they’re exempt from tax. Unless you can produce a valid exemption certificate, the state or jurisdiction where you are registered will expect you to have collected the sales tax.

These exemptions can save you significant money, so understanding who qualifies and how to claim is worth it.

State sales tax exemption: Out-of-state purchases

Whether you’re exempt from sales tax for out-of-state purchases depends heavily on the specific situation and the regulations of both states.

Generally, you are NOT exempt from sales tax for out-of-state purchases unless:

- You’re buying exempt goods: Food and prescription drugs are often exempt from sales tax in most states. Check the specific regulations of the state where you’re making the purchase.

- You’re buying for resale: Wholesalers and retailers may be eligible for sales tax exemptions through resale certificates.

- The seller has no nexus in your state: If the seller has no physical presence, employees, or economic ties in your state, they might not be required to collect sales tax on your purchase.

But to be absolutely sure, here are some resources to help you determine if you are responsible for sales tax on out-of-state purchases.

- Visit the tax website of the state you’re researching. Each state’s tax website should have information about sales tax exemptions and use tax

- The IRS’s Publication 334 provides information on federal sales tax regulations

- Consulting with a tax professional can help you understand your specific situation and responsibilities

How to get sales tax exemptions

It’s your legal right to claim for tax exemptions. Following the proper tax procedures will ensure you get issued the tax exemptions certificate needed to exercise it.

It’s pretty simple:

Identify your potential exemption

Research the specific exemptions offered in your state and work out which applies to your purchase.

- Federal, state, and local governments, along with registered non-profits dedicated to specific activities, often qualify for exemptions

- Individuals with disabilities may be exempt from medical equipment or supplies, and veterans may have exemptions depending on service and disability status

- Resale purchases, manufacturing materials, and specific equipment used in production may be exempt

- Out-of-state purchases or temporary residency in a new state may offer grace periods from sales tax

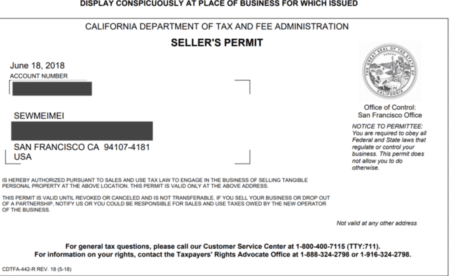

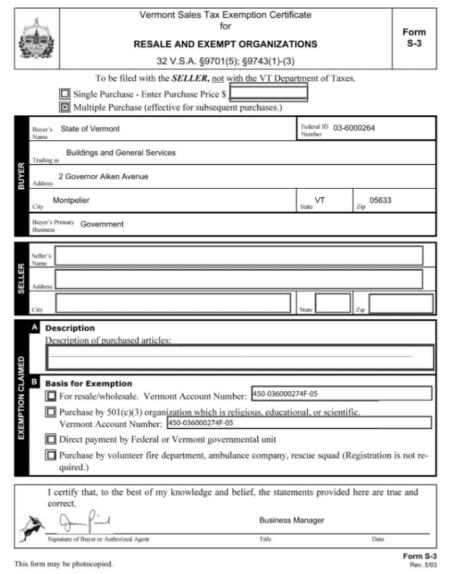

Apply for an exemption certificate

In most states, you’ll need to show an official exemption certificate to the seller at the time of purchase to claim your exemption.

To start your certificate application:

- Contact your state tax agency or relevant organization to obtain the necessary form

- Fill in the form and provide documentation, such as proof of non-profit status or temporary residency

- Submit the application and wait for approval

Complyt tips

- Don’t take for granted that what qualifies in one state as a tax exemption will apply to another – check the regulations for your location

- It’s not worth the risk of claiming an exemption you’re not eligible for just to save money when you factor in the risk of fines and back taxes

How to qualify for tax exemption

Qualifying for tax exemptions can be complex and vary depending on the specific type of exemption you’re seeking. Here’s how you could start.

1. Identify the exemption you seek

- Goods: Different states and countries have varying lists of exempt goods, including food, prescription drugs, and agricultural products. Research the specific exemption you’re interested in

- Services: Certain professional services like healthcare and education may be exempt in some jurisdictions. Understand the specific service you’re providing and its potential exemption

- Resale: If you’re buying goods for resale, you may be eligible for a resale certificate that exempts you from paying sales tax initially

2. Research the eligibility criteria

- State tax websites: Each state has its tax website with detailed information on exemptions and eligibility requirements. Consult the relevant website for the specific exemption you’re seeking

- Government publications: Official government publications like tax codes and regulations outline the precise criteria for each exemption. Familiarize yourself with the relevant document for your jurisdiction

- Professional resources: Consulting with a tax professional can be invaluable, especially for complex situations. They can help interpret regulations and advise you on the best course of action

3. Gather Supporting Documentation:

- Proof of Purchase: Depending on the exemption, you may need receipts, invoices, or other documents to prove your purchase qualifies.

- Resale Certificates: If you’re claiming a resale exemption, obtain valid resale certificates from the state you’re purchasing from.

- Business Licenses and Permits: Depending on the exemption, you may need to provide proof of your business license or relevant permits.

4. Apply and submit the necessary documentation

- Depending on the exemption, you may need receipts, invoices, or other documents to prove your purchase qualifies

- If you’re claiming a resale exemption, obtain valid resale certificates from the state you’re purchasing from

- Depending on the exemption, you may need to provide proof of your business license or relevant permits

5. Apply for the Exemption (if applicable)

- Some states require you to register for and obtain a resale certificate before claiming the exemption. Follow the state’s specific application process

- Certain exemptions may require additional paperwork or filing. Consult the relevant government agency for specific instructions

6. Stay Informed and Compliant

- Tax laws and regulations can evolve. Stay updated on any changes that might impact your exemption eligibility

- Maintain accurate records of your purchases, documentation, and claims for potential future audits

Always remember, when in doubt, consulting with a tax professional can provide tailored advice and help avoid costly mistakes.

Streamline your tax exemption experience – with Complyt

- Automate many of the manual tasks associated with claiming tax exemptions

- Manage and store reports, certifications, and exemptions in one place

- Simplify monitoring, calculating, and remitting sales tax

For more information, please get in touch with our team.