Unlike well-heeled enterprises, most fledgling startups aren’t blessed with a team of in-house tax wizards. If you’re juggling rapid growth, frequent rule changes, and a complex web of regulations – on top of ensuring your startup doesn’t join the legions of startups that fail every year – this blog’s for you.

Seven common sales tax registration slipups for startups

Let’s start with the easiest mistake of all to avoid.

Slipup 1: Not registering at all

Assuming that your company only needs to register after hitting a certain income threshold is a damaging urban sales tax legend. The golden rule is any startup becomes responsible for sales tax registration when they make their first taxable sale, regardless of the sale amount. Failing to do so can unwittingly set your company up for a dreaded audit.

Compliance tip: Even during periods of low income, it pays to register since demonstrating consistent compliance is an asset when seeking funds or partnerships.

Slipup 2: Using the wrong NAICS code

The North American Industry Classification System (NAICS) code is used to identify your business type and determine applicable sales tax rates. It’s a simple mistake, but details matter in sales tax compliance. Tiny oversights like using an incorrect code can result in miscalculations and potential penalties.

Slipup 3: Handling exception incorrectly

Mistakes are essential to growth, but avoid this one altogether if you can. Specific tax exemptions may apply to your products or services. If you’re not factoring this in, you may be overcharging customers or, just as damaging, undercharging, leading to unpaid taxes, fines, and audit risk.

Complyt tip: Research and identify the applicable exemptions in each jurisdiction where you operate. Read more on the risks posed by tax-exemptions.

Slipup 4: Not leveraging the Streamlined Sales Tax (SST) program

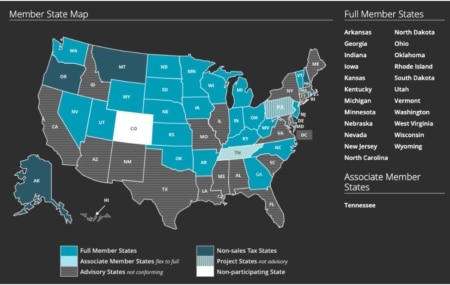

The Streamlined Sales Tax program, or SST, is a multi-state initiative. Like Complyt, they’re working to simplify sales and use tax compliance. How? With SST, your business can use one state sales tax registration form to register automatically in all 24 participating states.

Complyt tip: Even if you only operate two of the states below, you can halve the time you spend filling out registration forms.

Source: https://www.streamlinedsalestax.org/

Slipup 5: Not checking if your digital products and services are taxable

SaaS and eCommerce companies may be digital natives. Still, the laws taxing digital products are made in the brick-and-mortar halls of government buildings – and each state taxes digital products and services differently.

Complyt tip: Don’t take a one-size-fits-all approach to sales tax because there are no Federal sales in the U.S. Tax. Instead, each state has the authority to establish its sales tax laws, rates, and regulations.

Slipup 6: Not registering in states where you have economic nexus

No start-up has time for penalties, fines, and audits. It’s why understanding nexus, the legal connection that triggers your sales tax obligation, is crucial. Here are three things to keep in mind.

Firstly, nexus can be established in two ways:

| NEXUS TYPE | EXPLANATION |

| Physical Presence | You likely have nexus there if you have any physical ties to a state, like an office, warehouse, or even attending a trade show. |

| Economic Activity | This means exceeding a certain sales threshold in a state, even without a physical presence. Reaching this threshold, known as the economic nexus threshold, creates a sales tax obligation. |

Secondly, each state has rules and thresholds for physical and economic nexus.

Lastly, all startups must register for sales tax in states where they trigger nexus. Failure can lead to significant penalties and fines.

Complyt tip: (How do you know you’ve established economic nexus?)

Slipup 7: Ignoring the tax implications of remote employees & state taxes: a critical pitfall for startups

When is your physical nexus no longer your office? When your remote or traveling teams work in states where your business is registered. For example, if you have salespersons traveling the conference circuit and making transactions, they may trigger a physical nexus in a new state.

Complyt tip: Keep track of your team’s locations and a record of all transactions they’re making in each state. Read more: SaaS Sales Tax.

What are the pitfalls of getting sales tax registration wrong?

Here’s why sales tax registration is vital for startups:

1. Compliance and avoiding penalties

Registering demonstrates your commitment to complying with state and local tax laws. It prevents fines and penalties. Unregistered startups face potential audits and back taxes, impacting their financial health.

2. Building trust and reputation

Many potential partners and investors require startups to be tax-compliant before entering into agreements or providing funding. Sales tax registration can be a prerequisite for business partnerships and securing investments.

3. Laying a foundation for growth

Establishing a compliant sales tax framework allows you to scale your business smoothly and expand into new jurisdictions without legal hurdles. Proper registration and tax collection streamline your business operations. It helps you keep track of your financials accurately and simplifies tax reporting and filing processes.

4. Avoiding legal issues

Non-compliance can trigger audits, which are time-consuming and especially costly for lean startups. Failing to register and collect sales tax can also lead to legal action from state authorities, damaging your reputation and distracting you from core operations.

5. Avoiding Back Taxes

Unregistered startups risk accumulating back taxes, which can be a significant financial burden on your growth trajectory. Sales tax registration ensures you collect and remit taxes correctly, dialing down your risk exposure from your first taxable scale, no matter the sale amount.

Steps to a successful sales tax certificate of registration

Timing is everything when it comes to how to do sales tax registration. Remember, it’s crucial to register for sales tax before making taxable sales to avoid potential penalties and fines.

- Determine and register in states where you have nexus: Nexus is the connection between your business and a taxing authority, triggering the obligation to collect sales taxes

- Research and identify applicable exemptions: Understand your potential exemptions in each operating jurisdiction to prevent overcharging or under-collecting taxes

- Collect necessary information: Gather data like business structure and NAICS code info; this categorizes your business for correct tax rates

- Research state regulations: Understand the specific laws, rates, and exemptions applicable to each state where you have nexus. (States may have different rules and forms)

- Complete registration forms: Fill out the sales tax registration forms for each state and submit them to the appropriate tax authorities in each state. (Find these on the state’s Department of Revenue website)

- Verify tax rates: Confirm the applicable sales tax rates for each jurisdiction within the state where you will collect tax

- File for permits: If required, file for any necessary permits or licenses along with your sales tax registration; they ensure you’re operating legally

- Register online if available: Many states offer online registration, which can streamline the process and provide faster approval

- Seek professional help: If you’re unsure about the process or need assistance, consider consulting with a tax professional or using professional sales tax compliance software like Complyt

Startups never slip up with Complyt

Complyt is an automated system for sales tax registration that simplifies startup sales tax compliance without needing a resident tax expert in your department employed 24/7. It eliminates the mistakes that most startups make.

Here’s how:

- nexus determination

- collect sales tax accurately

- automate filing and remittance

- stay updated with regulations

- compliance for remote employees

Book your free demo today to see how Complyt keeps your startup from ending up on the audit radar.